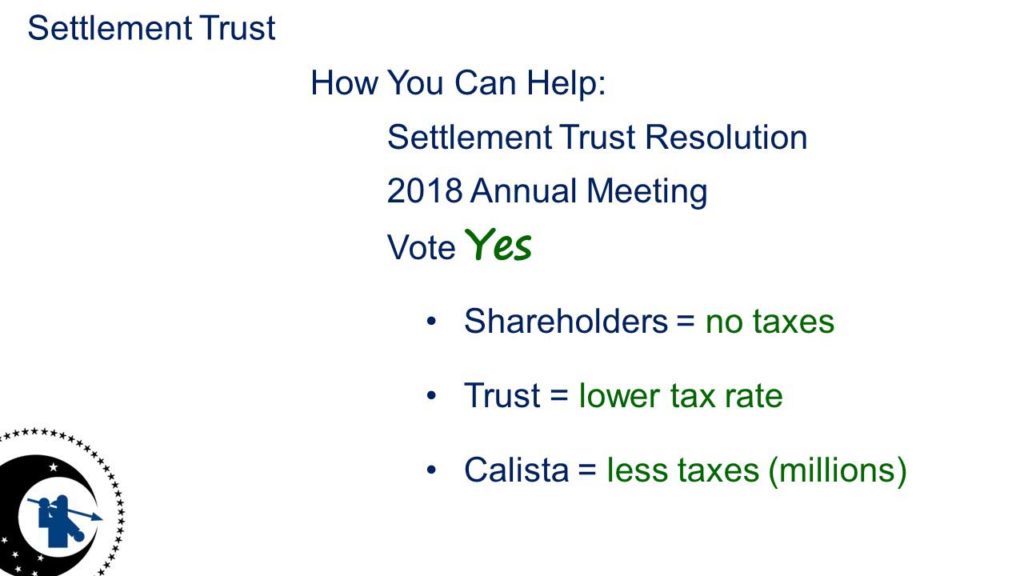

You can make your voice heard on the Alaska Native Settlement Trust. Vote online, by mail or at the Annual Shareholders Meeting by July 2018. Here is why you should vote YES on the Settlement Trust Resolution:

Tax advantages to Shareholders: Calista dividends are estimated to become taxable in 2021. This means you as a Shareholder will be required to include Calista dividends as part of your taxable income to the IRS starting in about 2021. If the Settlement Trust Resolution passes, distributions from the Trust generally would not be taxable.

Tax advantages to Calista: Alaska Native Corporations can create a Settlement Trust, which pay taxes at a much lower rate than corporations. If the Settlement Trust Resolution passes, the Trust, rather than Calista, would pay taxes on the funds distributed to shareholders. This means that Calista will have more of its funds available to distribute to shareholders

Requirement to pass: A majority (over 50%) of shares present or represented by proxy at the Annual Meeting must vote Yes. For example, if 100 shares are at the meeting, but only 50 shares vote Yes, this resolution will not pass.

Vote at CalistaVote.com

Calista Corp. President/CEO Andrew Guy talks of the importance to pass the Settlement Trust Resolution

-

Presentation

View the slides below for an overview of the Settlement Trust, advantages, and disadvantages. The FAQs provide the most details.

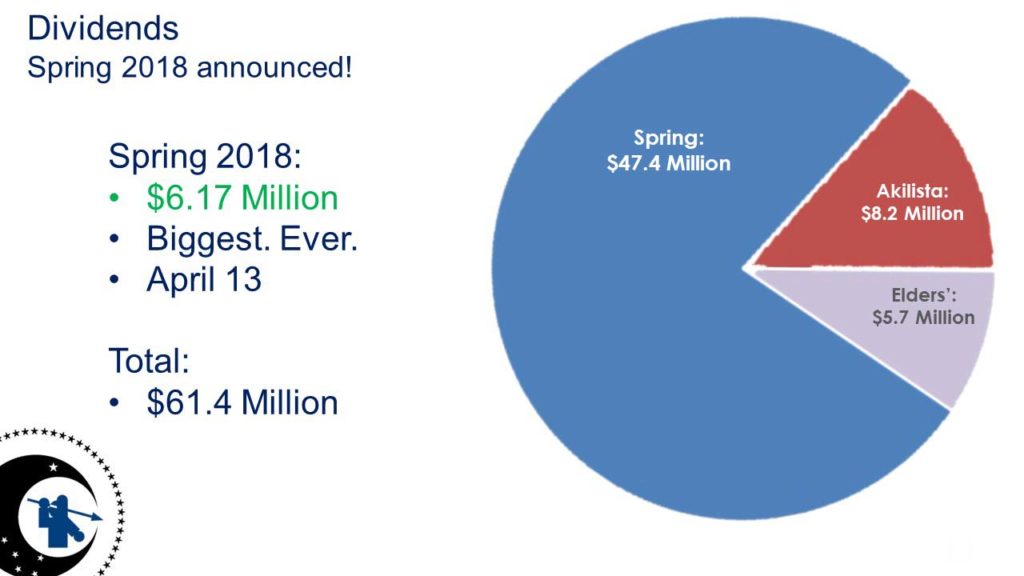

Calista Corporation has declared a total $61.4 million in dividends in our history.

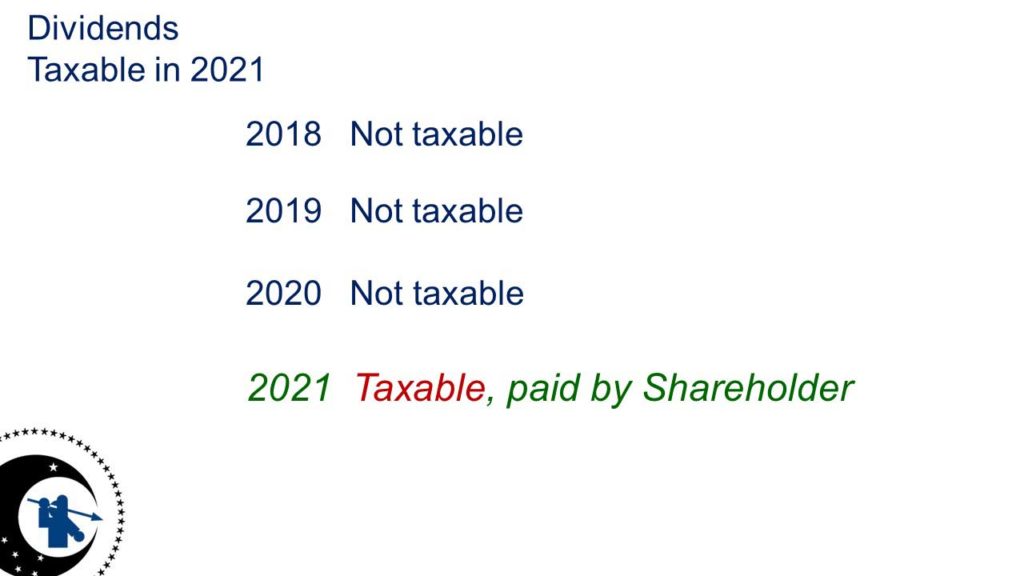

Calista Shareholder dividends are currently not taxable. However, your dividends are estimated to become taxable beginning in 2021.

Calista estimates that for every $100 in dividends, Shareholders will need to pay $20 in taxes.

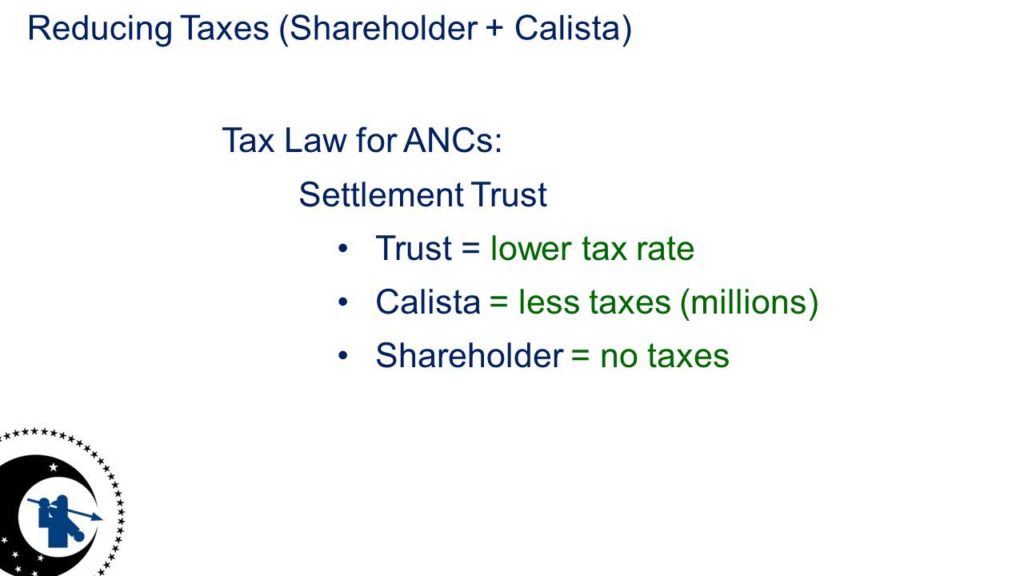

With Shareholder approval, Alaska Native Corporations can create a Settlement Trust to pay for dividends. This type of trust has a lower tax rate, Calista will pay less in taxes and Shareholders would pay nothing out of their pocket in taxes.

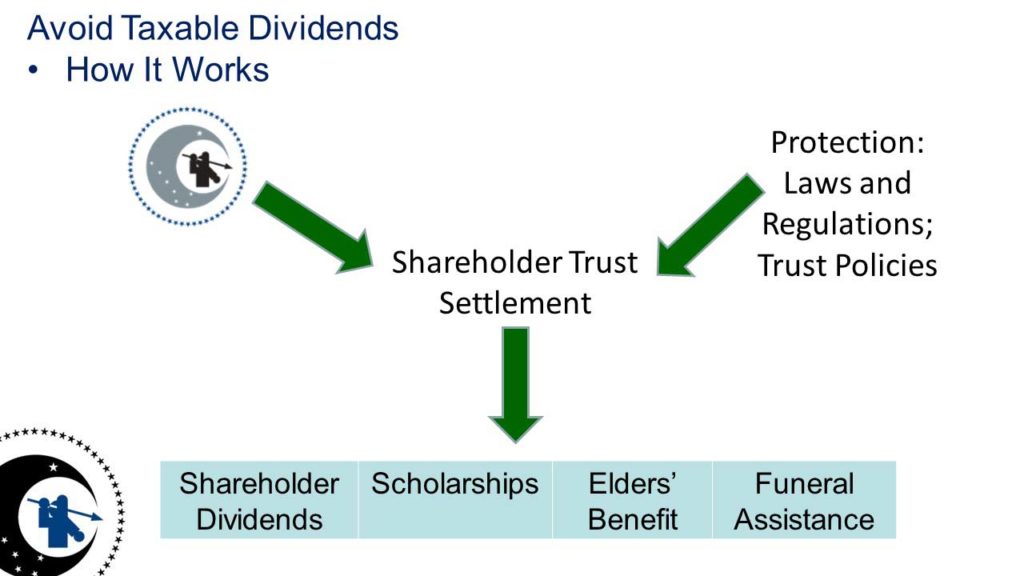

Overview of how the Settlement Trust would work:

- Calista would make contributions to the Shareholder Trust

- Laws and regulations protect the Trust with protections on reporting, management and types of investments

- The Trust could then make distributions for things like:

- Shareholder dividends

- Scholarships

- Elders’ Benefits

- Funeral Assistance

Many ANCs already have a Trust, including Ahtna, Afognak and Goldbelt. Some ANCs have Elders’ Settlement Trusts, including CIRI and NANA. Old Harbor Native Corp. sponsored the legislation to get the ANC Settlement Trust passed by Congress.

Shareholders from other ANCs already have to pay taxes on dividends, including ASRC, CIRI, Doyon and NANA.

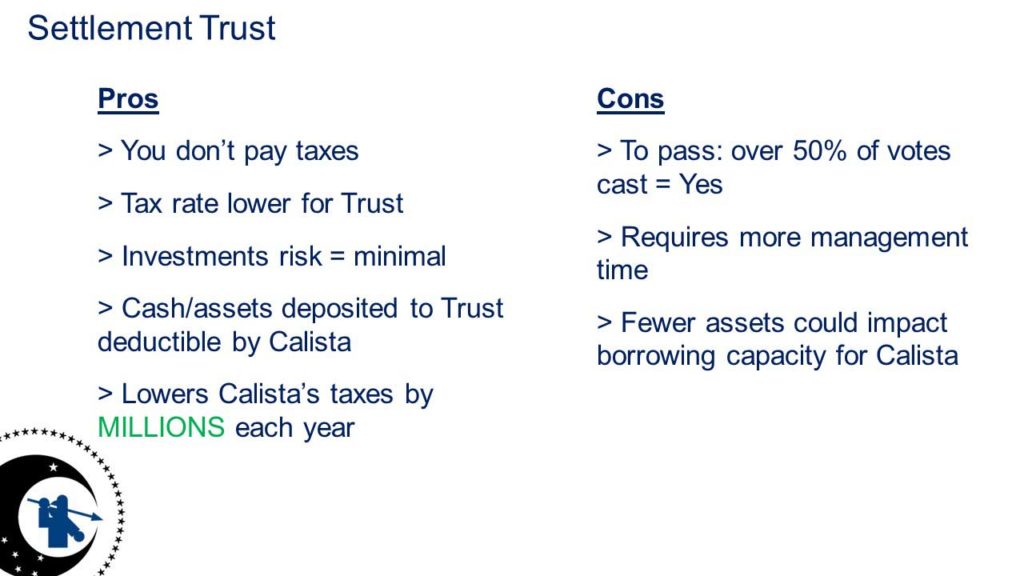

Pros and Cons of a Settlement Trust:

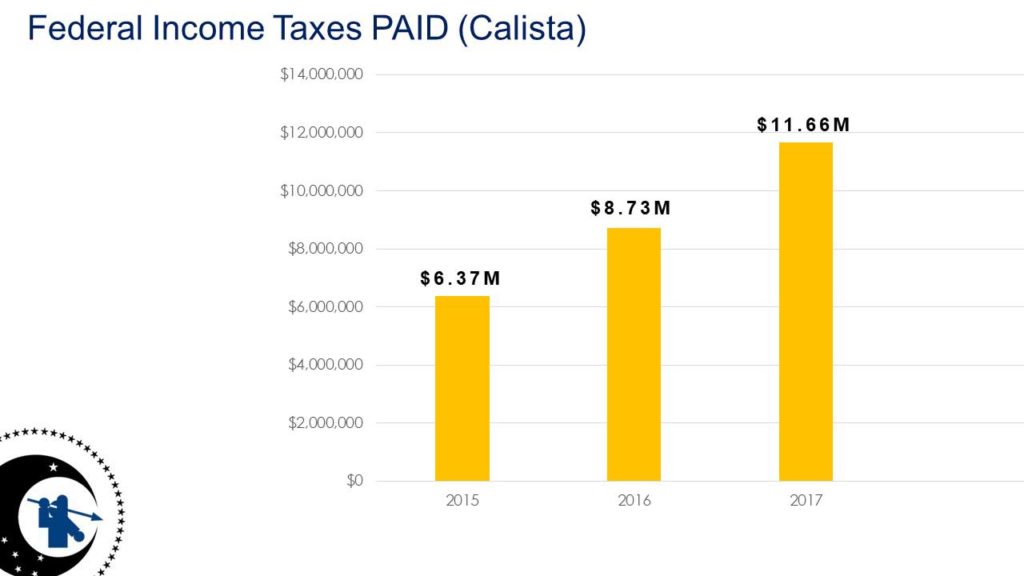

As Calista grows, so does the amount we have to pay in corporate federal taxes. Here are actual Federal and state income taxes paid the last few years.

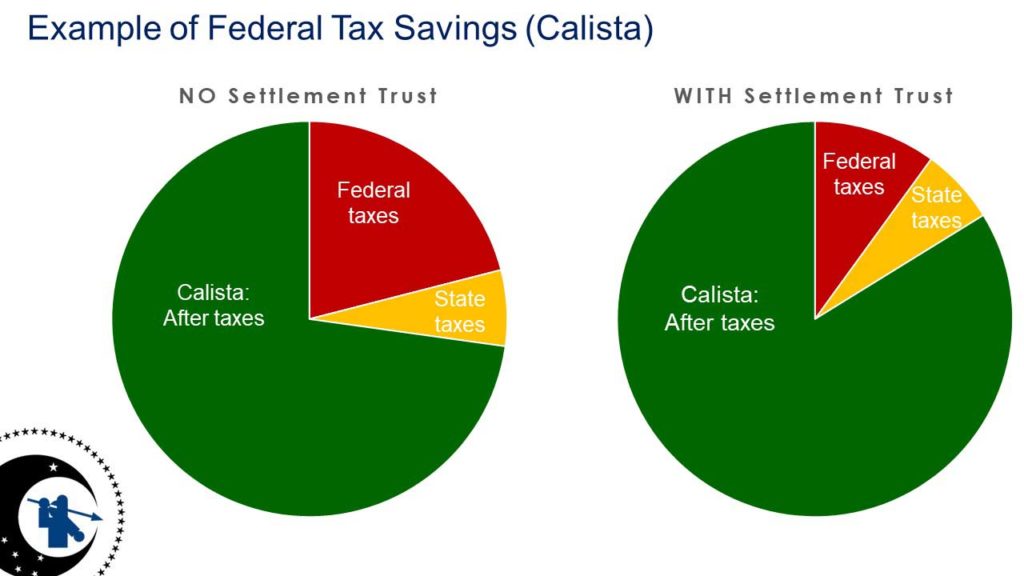

With a Settlement Trust, Calista could save millions of dollars in Federal Taxes. That could mean more could be set aside for dividends, scholarships, funeral assistance, donations and more.

- Right now, Calista pays 21% in Federal Taxes

- Plus another 6.2% in State Taxes

- Without a Settlement Trust, Calista pays millions of dollars in Federal Taxes

For this year’s Annual Meeting, there will be a resolution to create a Settlement Trust. Please vote YES and encourage other Shareholders to vote YES.

All slides

-

FAQs

The following Frequently Asked Questions address many Shareholder questions about the Alaska Native Settlement Trust (“Settlement Trust” or “Trust”). Calista Corporation (“Calista”) will seek Shareholder approval at the July 6, 2018 Annual Meeting of Shareholders.

Click here to view and/or download the PDF version of the FAQs

Q: What has happened so far?

A: On February 16, 2018, the Calista Board of Directors (“Board”) adopted a resolution to place a resolution before the Shareholders at the July 2018 Annual Meeting of Shareholders to establish an Alaska Native Settlement Trust.

Q: What are the advantages of the proposed settlement trust?

A: There are a variety of advantages to settlement trusts, but the most important are:

- (a) permanence and long‐term Shareholder benefits;

- (b) significant tax advantages for both Shareholders and Calista; and

- (c) protection from creditors

OVERVIEW OF KEY CONCEPTS AND TERMS OF THE SETTLEMENT TRUST

Q: What is a settlement trust?

A: A settlement trust is a trust organized under the provisions of the Alaska Native Claims Settlement Act (ANCSA) and Alaska law to provide certain benefits to the Shareholders of an Alaska Native Corporation (ANC).

Q: What is the settlement trust’s purpose?

A: The purpose of a settlement trust is to promote the health, education, and welfare of Calista’s Shareholders (the settlement trust’s beneficiaries) and to preserve the heritage and culture of Natives. The settlement trust will accomplish this by making distributions to its beneficiaries.

Q: Have other Alaska Native Corporations adopted settlement trusts?

A: Yes. Many ANCs have created and funded settlement trusts.

Q: What will the settlement trust be called?

A: The Calista Corporation Settlement Trust.

Q: What documents will establish the settlement trust?

A: The settlement trust will be created by a Settlement Trust Agreement.

Q: Who are the participants in a settlement trust?

A: The “settlor,” “grantor,” or “trustor” creates the settlement trust and initially contributes assets to the settlement trust. For the proposed Calista Corporation Settlement Trust, the “settlor,” “grantor,” or “trustor” will be Calista. The “trustees” are people who manage the settlement trust. The “beneficiaries” are the people who receive benefits provided by the settlement trust.

Q: Who will be the settlement trust’s beneficiaries?

A: Individuals who own shares of stock in Calista, but only while they own shares, so long as those individuals did not receive shares in a manner not permitted by ANCSA. If a Calista Shareholder gives away all of his or her Calista shares, he or she will cease to be a Calista Shareholder and also will cease to be a beneficiary of the settlement trust. A custodian for a child’s Calista shares will be treated as the custodian for the child’s beneficial interest in the settlement trust.

Q: Can Calista add new beneficiaries to the settlement trust?

A: Yes, through inheritance, gifting, and as new Calista Descendants or missed enrollees are enrolled, so long as individuals received the stock in a manner permitted by ANSCA.

Q: Who will control or manage the settlement trust?

A: The trustees will manage the settlement trust. ANCSA requires the trustees of a settlement trust be individuals. Thus, a bank or trust company cannot serve as trustee. There will be five initial trustees, but this could change in the future. The Calista Board will appoint all trustees, and it can remove any trustee for cause.

Q: Does this mean a bank or other financial institution cannot advise the settlement trust?

A: No. The trustees can hire professional advisors, including investment advisors or managers; however, the trustees maintain the ultimate control over the settlement trust.

Q: How will the trustees make decisions?

A: The Trustees will act by majority. In investing its assets, the trustees are required to invest the assets as a prudent investor would.

Q: How will the trustees decide how much to distribute to the beneficiaries?

A: The Trustees will have the discretion to make distributions to the beneficiaries. Distributions can be made on a pro rata basis (according to how many shares a beneficiary owns), a per capita basis (for example, $50 to each shareholder, regardless of how many shares he or she owns), and the Trustees may create separate funds for special purposes, such as an Elders’ fund or a scholarship fund.

Q: Will the trustees have fiduciary duties?

A: Trustees owe a fiduciary duty to all beneficiaries. Alaska law and the Settlement Trust Agreement requires each trustee to act in good faith, as a prudent person would, using reasonable care, skill, and caution for the best interest of the beneficiaries of any fund created in the settlement trust. The basic fiduciary responsibility for overseeing the settlement trust cannot, however, be delegated by the trustees to a third party. Certain administrative functions may be delegated.

Q: Will the trustees be paid?

A: Trustees shall not receive compensation but may be reimbursed for their reasonable expenses in acting as a trustee.

Q: Will Calista directors, managers, or employees get any special benefit from the settlement trust?

A: No.

Q: What is the relationship between the settlement trust and Calista’s Annual Meeting proxy statement?

A: Calista’s proxy statement, along with a copy of the settlement trust, will be sent to Shareholders with the proxy statement, proxy, and annual meeting materials when they are ready for distribution. The proxy statement is Calista’s definitive statement describing the proposed settlement trust; it describes the nature and effect of the settlement trust more completely and accurately than can be provided in these questions and answers. These answers are for reference only. If there is any discrepancy between the proxy statement and these questions and answers, the proxy statement will control.

Q: What is the relationship between Calista and the settlement trust?

A: Calista and the settlement trust will be closely affiliated, but will be separate legal entities. Calista will contribute assets to the settlement trust, certain members of Calista management will be the initial trustees, and eligible Calista Shareholders will be the beneficiaries. Calista will provide administrative services to the settlement trust, such as maintaining its accounting records. However, the settlement trust will own its own assets, the settlement trust will file its own tax returns and pay its own taxes, and the trustees will make their own independent decisions regarding distributions and management of the settlement trust. Unlike Calista subsidiaries, the assets, liabilities, income, and expenses of the settlement trust will not be consolidated into the Calista financial statements and tax returns. The settlement trust and its assets will not be liable for Calista’s debts and obligations, and Calista will not be liable for the settlement trust’s debts and obligations.

Q: Will creating the settlement trust affect Calista?

A: Assets contributed to the settlement trust will no longer be available to Calista. Calista will not be able to use the contributed assets to invest in new businesses or opportunities, or as collateral for loans. After Calista contributes assets to the settlement trust, Calista will not be able to distribute these assets to its Shareholders and will not receive earnings on the assets. This likely will replace some or all of Calista’s dividends and distributions to its shareholders with distributions made by the settlement trust to its beneficiaries. The Calista Board will take these impacts into account when it decides whether to contribute assets to the settlement trust, and what assets to contribute.

Q: Will the settlement trust’s business differ from Calista’s business?

A: The settlement trust is prohibited by law from “operating as a business.” Therefore, the settlement trust may only own and manage passive investments. These investments may include marketable securities, cash, Calista‐owned minority interest companies, and similar investments. Also, the settlement trust is barred from transferring interests in land received from Calista except back to Calista.

Q: Can the settlement trust be amended?

A: Yes, for limited purposes. The trustees may appoint an “independent trustee” who is not a shareholder, director, employee, or officer of Calista, who may amend the terms only to the extent necessary to permit the settlement trust to continue to qualify as an Alaska Native Settlement Trust under ANCSA. The trustees are required to notify the beneficiaries (the shareholders) about the amendment.

Q: Who will keep track of beneficiaries and do the bookkeeping for the settlement trust?

A: Calista will provide administrative services for the settlement trust to identify and communicate with beneficiaries and account for settlement trust assets and distributions.

Q: How long will the settlement trust last?

A: The Settlement Trust could last forever but is authorized to be terminated when the value of the settlement trust is less than $50,000. The trustees will decide whether to terminate the trust at that time.

Q: What happens if the settlement trust terminates?

A: After paying the settlement trust’s debts, all assets of the Settlement Trust, except for any land that the Settlement Trust received from Calista will be distributed to the beneficiaries. Except for any land that the Settlement Trust may have received from Calista, no assets will be returned to Calista.

SETTLEMENT TRUST BENEFITS AND DISTRIBUTIONS

Q: What are examples of benefits a settlement trust may provide to its beneficiaries?

A: For example, a settlement trust can provide scholarships, burial assistance, cash distributions to its beneficiaries and Elders’ benefits.

Q: Will Shareholders have to approve distributions made by the settlement trust?

A: No, distributions are approved by the trustees.

Q: Can a Shareholder sell his or her interest in the settlement trust to someone?

A: A shareholder cannot sell his or her interest in the Settlement Trust.

Q: Can a Shareholder give his or her interest in the settlement trust to someone?

A: A shareholder cannot give his or her interest in the settlement trust directly. However, a shareholder can indirectly transfer his or her interest in the settlement trust to another by transferring his or her Calista shares as permitted by ANCSA. Upon giving shares to someone, the recipient would become a Calista Shareholder and a settlement trust beneficiary. If a Shareholder gives away all of his or her Calista shares, he or she will cease to be a Calista Shareholder and also will cease to be a settlement trust beneficiary. Shares and beneficial interests can be given only to someone whom ANCSA permits. The same rules apply to transfer at death – whoever inherits the Calista shares when a Shareholder dies will also become a settlement trust beneficiary. The beneficial interest cannot be inherited separately from the Calista shares. A shareholder cannot gift all of the shareholder’s Calista shares while keeping an interest in the settlement trust.

Q: How will distributions be paid among the beneficiaries?

A: Distributions may be paid proportionally to each beneficiary’s Calista shares, so a beneficiary owning 200 shares may receive twice as much in distributions from the settlement trust as a beneficiary owning 100 shares. The settlement trust also permits distributions per capita, where each beneficiary would receive the same amount, regardless of how many shares of Calista stock are owned by the beneficiary. Finally, the trustees may establish separate funds with for specific purposes and for specific beneficiaries. For example, the trustees may establish an “Elders’ Fund” and make distributions to beneficiaries who have attained a given age. As another example, the trustees may establish an “Education Fund” and make distributions to those beneficiaries who are pursuing college or professional education.

Q: Will use of a settlement trust disqualify a beneficiary from federal needs‐based eligibility programs such as SNAP (food stamps)?

A: It is clear from ANCSA that the beneficiary’s interest in the settlement trust is not to be counted in determining eligibility. However, it is not clear whether cash distributions from a settlement trust can be excluded in the same way that the first $2,000 of cash distributions from a Native Corporation are excluded. The language allowing the $2,000 exclusion refers only to distributions by a Native Corporation.

Q: Can a creditor seize a Shareholder’s beneficial interest in the settlement trust?

A: Under ANCSA, no. Also, state law restrictions prohibit most creditor actions involving a beneficial interest in a trust. The exceptions for child support and perhaps IRS claims would apply to beneficial interests to the same degree they apply to Calista shares.

Q: Can Calista’s creditors go after the assets of the settlement trust to satisfy Calista’s debts?

A: It depends. The assets of a settlement trust are subject to the claims of Calista creditors if the claims arose before the assets were placed in the settlement trust. In other words, Calista cannot transfer assets to a settlement trust to avoid paying creditors existing at the time of the transfer. On the other hand, if a creditor’s claim arises against Calista after the assets are transferred to the settlement trust, the settlement trust is not liable for that claim.

Q: Can ANCSA land placed in a settlement trust be seized by Calista’s creditors or subjected to bankruptcy?

A: In general, the settlement trust only has to answer for its own debts and the debts and obligations of Calista at the time Calista establishes the settlement trust. Calista’s debts and obligations that arise after assets are conveyed to the settlement trust cannot be recovered from the settlement trust. Moreover, ANCSA land in a settlement trust has all the same protections that land could have if owned by Calista itself. These protections automatically apply to ANCSA land so long as the land is not developed, leased or sold to third parties. Additionally, ANCSA land cannot be seized by a creditor unless Calista or the settlement trust waives in writing its protection from such seizures. One advantage to having ANCSA land in a settlement trust is that such land cannot be sold to third parties.

Q: Can the creditors of a Shareholder sue the settlement trust to recover the Shareholder’s debt?

A: Generally, the settlement trust can only be sued for its own debts and not those of the Shareholder-beneficiaries. However, it is not clear whether a distribution otherwise payable to a beneficiary could be seized by a beneficiary’s creditor before that distribution is actually paid to that beneficiary. ANCSA expressly protects corporate distributions from being seized by a Shareholder’s creditor before distribution but does not specify whether the same protection applies to pending distributions from a settlement trust. It is also an open issue whether the Child Support Enforcement Division can reach settlement trust assets to satisfy a beneficiary’s child support obligation.

Q: Is there any requirement that a settlement trust distribute a particular percentage of its annual income?

A: No, a settlement trust would not have to distribute any of its annual income unless required by the Settlement Trust Agreement.

CALISTA CONTRIBUTIONS TO THE SETTLEMENT TRUST

Q: What assets will Calista contribute to the settlement trust?

A: This is up to the Calista Board. It is likely Calista will contribute cash or marketable securities to fund shareholder dividends and Elders’ distributions through the trust as settlement trust distributions. Calista may also contribute interests in certain Calista subsidiaries, among other assets.

Q: Will Shareholders have to approve Calista contributing assets to the settlement trust?

A: No. That is a decision for the Calista Board. Unless the Calista Board contributes all or substantially all of Calista’s assets to the settlement trust, it may make contributions to the settlement trust without Shareholder approval.

Q: Are there limits on the amount or types of assets Calista can contribute to the settlement trust?

A: Yes. Calista may not contribute any assets that violate ANCSA or the Settlement Trust Agreement. ANCSA provides a settlement trust cannot operate as a business, engage in commercial harvest operations of contributed timber, or sell interests in real estate received from Calista. Under state law, Shareholder approval is required before Calista can transfer all or substantially all its assets to the settlement trust. State law also prohibits a transfer of assets to the settlement trust that would violate the Board’s fiduciary duties, such as a transfer that renders Calista insolvent.

TAX TREATMENT OF SETTLEMENT TRUST

Q: Will distributions a beneficiary receives from the settlement trust be taxed?

A: In general, distributions by the settlement trust will not be taxable for the beneficiaries.

Q: How will creating and funding a settlement trust affect the amount of distributions I receive?

A: The distributions to settlement trust beneficiaries should, over time, be larger than had dividends and Elders’ distributions been paid directly from Calista. This is because Calista’s tax payments are expected to be significantly lower, net of tax payments made by the settlement trust.

Q: Will the settlement trust’s income be taxed?

A: The settlement trust will be taxed on its income, including contributions from Calista, and will pay its own taxes. The settlement trust will be taxed at a 0% or 10% rate, depending on the type of income.

Q: Will the amount of Calista’s earnings affect the taxability of distributions to the beneficiaries

A: No.

Q: Will contributions by Calista to the settlement trust be taxed?

A: Contributions to the settlement trust are tax deductible for Calista and are taxable to the settlement trust.

Q: For tax purposes, is the settlement trust consolidated with Calista in the same way a Calista subsidiary is?

A: No. The settlement trust must file its own tax return.

NEXT STEPS

Q: Will Shareholders have to approve creating the settlement trust?

A: Yes. To create the Calista Corporation Settlement Trust, a majority (over 50%) of the shares present or represented by proxy at the Annual meeting of Shareholders at which a quorum is present must vote in favor of creating the settlement trust.

Q: How can I get a copy of the settlement trust?

A: The settlement trust will be available for review in the annual meeting materials when they are sent to Shareholders.

-

Settlement Trust Document

Formally called a Settlement Trust Agreement, this document would be used to legally establish the Trust if the resolution passes.

Note: This document is included in the 2018 Annual Meeting packet mailed to each Shareholder household.

Click below to view or download the document (PDF | 1.2mb):

Calista Corporation Settlement Trust Agreement