Calista Corporation Settlement Trust 2020 Distributions Non-Taxable Income

1099 IRS Form Not Required for These Distributions

January 29, 2021

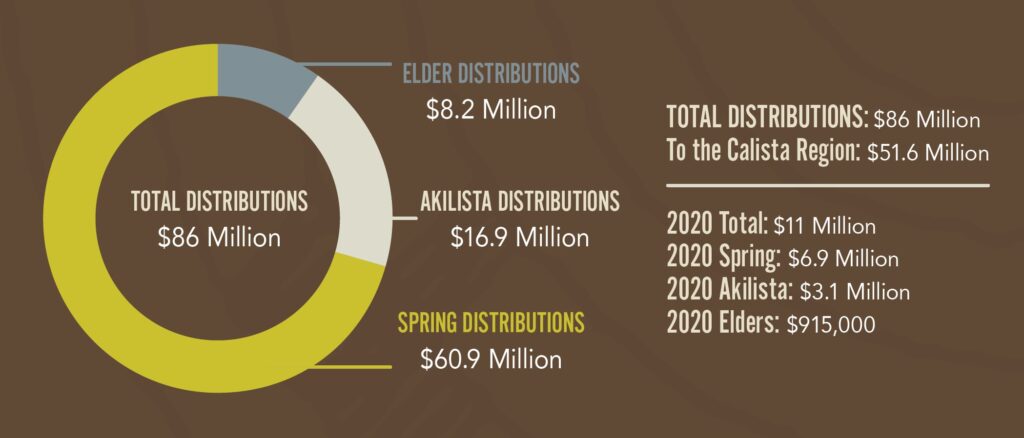

(Anchorage, Alaska) – Calista Corporation is pleased to announce that all 2020 Calista Corp. Settlement Trust distributions are non-taxable income. The 2020 Spring, Akilista and Elder distributions were paid from the Settlement Trust.

These distributions are not taxable, and Calista Shareholders will not receive a 1099 IRS form for them.

Log into your free and secure MyCalista.com account to see past distributions, review the types of shares you have, update your contact info and more.

Shareholders voted at the 2018 Annual Meeting to approve the creation of the Settlement Trust. In 2020, distributions from the Settlement Trust totaled $11 million, an increase of $1 million from 2019.

###

Calista Corporation has over 33,000 Shareholders and is the parent company of more than 30 subsidiaries in the following industries: defense contracting, construction, real estate, environmental services, natural resource development, marine transportation, oilfield services, and heavy equipment sales, service and rentals. Since 1994, Calista has provided more than $5.5 million in scholarships to its Shareholders and Descendants. Since inception, Calista has declared more than $77.8 million in dividends and distributions, and $8.2 million in Elders’ Benefit Program distributions to Shareholders. Calista can be found on Facebook, Twitter and Instagram.